The National Council of the Slovak Republic approved the amendment to the Slovak Income Tax Act (SITA). This amendment includes several changes and clarifications in the personal income tax area.

Two major changes of the SITA amendment concern the requirements and amount of the tax bonus for children and changes in the taxation of bonds.

As of the new year, the minimum amount of the taxpayer's income will no longer be considered when claiming the tax bonus. Newly, every taxpayer who has achieved taxable income (e. g. from employment or business) in a tax period can claim the tax bonus.

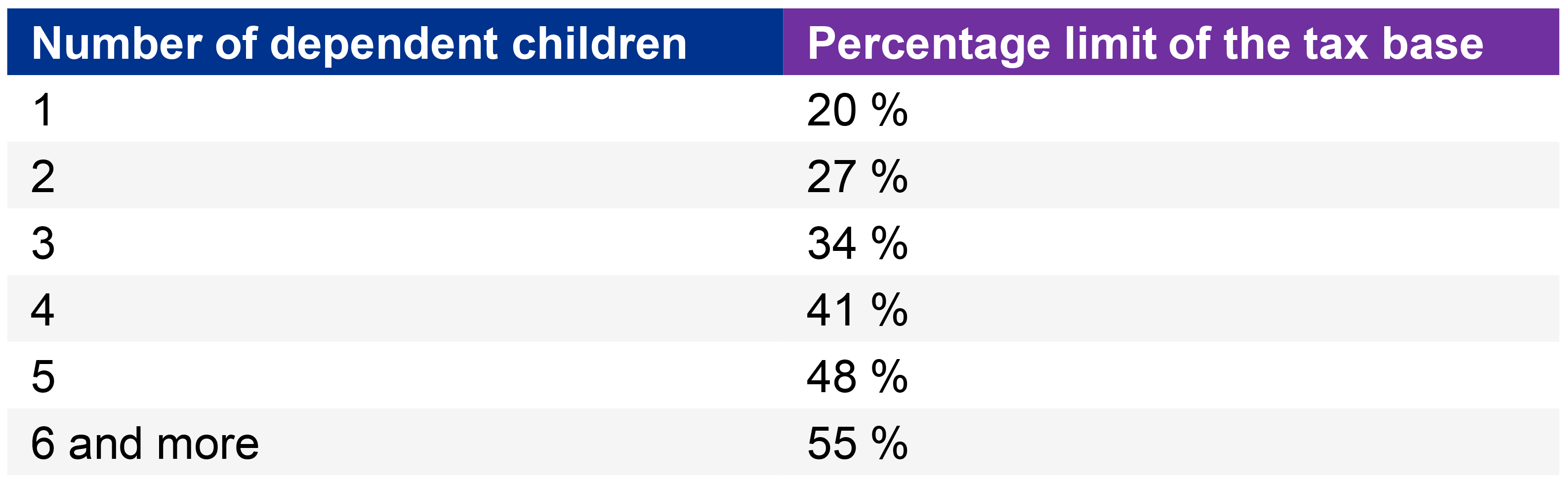

However, amount of the tax bonus is limited by the taxpayer's tax base. For example, a taxpayer who has one child can claim a tax bonus of up to 20% of his/her tax base. In the case of several dependent children, this percentage increases.

We summarize the statutory limits in the following table:

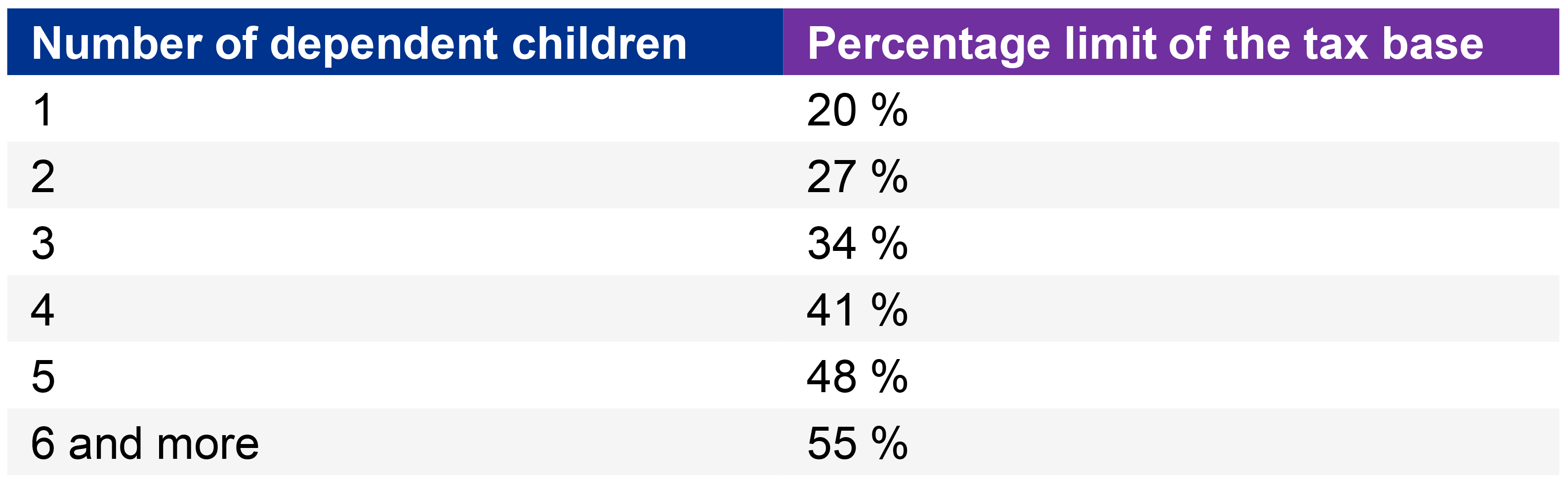

The amount of the tax bonus itself is (based on a transitional provision) for the years 2023 and 2024 determined as follows:

However, from 2025, the amount of the tax bonus returns to the originally intended level:

Another change introduced by the amendment is the possibility to increase the tax base by the tax base of the other parent if the taxpayer himself/herself does not have sufficient tax base to claim the entire tax bonus. This option can also be used by tax non-residents. We should note, however, that in such a case, at least 90% of worldwide income of both taxpayers must come from sources in the territory of Slovakia.

The amendment provides a beneficial treatment to employees to whom the employer paid during the year a higher tax bonus than they were entitled to. In such a case, the taxpayer does not have to return such (incorrectly) paid tax bonus.

The amendment to the SITA also introduces changes in the taxation of bonds as of the new year. From 1 January 2023, income from bonds paid out by Slovak tax residents will be considered income sourced from Slovakia and will be subject to withholding tax. This means that foreign investors (individuals or legal entities) do not have to receive the entire coupon yield from the Slovak issuers from whom they bought the bonds.

The amount of tax withheld can range from 0% to 19%, in extreme cases up to 35%. This amount depends primarily on whether Slovakia has concluded a Double Taxation Avoidance Treaty with the investor's country and what tax rate is agreed upon in the treaty. Therefore, bond issuers should now approach individual investors with a request for proof of tax residence, so that the issuers know what tax rate to apply on the income payment.

These new administrative obligations for investors may reduce their willingness to buy bonds of Slovak issuers (primarily banks).

The legislator did not provide for any transitional provision that would limit the effectiveness of this change. This means that from 1 January 2023, these new taxation rules apply also to bonds issued prior to this change, where the investors did not expect such taxation when purchasing the bonds.

Other changes that the amendment to the SITA introduces are mainly the following: