Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

In a NutshellCalifornia has two important laws — the Rosenthal Act and the Debt Collection Licensing Act — that protect California residents against original creditor and third-party debt collector harassment and abuse. Californians also benefit from the federal Fair Debt Collection Practices Act, which offers many protections and gives you certain rights. The statute of limitations for most consumer debt is four years in California.

Written by the Upsolve Team. Legally reviewed by Attorney Andrea Wimmer

Updated November 8, 2023

Three main debt collection laws protect Californians:

As you can see, two of the laws have almost identical names, but one is a state law and the other is a federal law. The protections they provide are similar, but California’s law applies to both original creditors and third-party debt collectors, so it offers even more protection for California consumers. The federal FDCPA only applies to third-party debt collectors. The main goal of both of these laws is to prevent harassment, deception, and unfair actions in debt collection.

Learn more about each law below.

California’s Rosenthal Fair Debt Collection Practices Act was enacted to protect consumers from unethical debt collection practices. The Rosenthal Act is modeled after, but expands on, the federal consumer protection law (the FDCPA).

One big distinction is that both original creditors and debt collectors (including debt collection agencies and debt buyers) have to follow the Rosenthal Act. The federal FDCPA does not apply to original creditors. The California FDCPA also applies to people who make and sell forms and letters for use in debt collection activities

Another big benefit of the Rosenthal Act is that it considers foreclosure a debt collection activity. The federal FDCPA does not.

The Debt Collection Licensing Act took effect on Jan. 1, 2022, in California. Under the act, all debt collectors in California must:

For more information on why this is important, read the section titled California Requires Debt Collectors To Be Licensed below.

Californians and others across the U.S. benefit significantly from the federal Fair Debt Collection Practices Act (FDCPA). This law aims to protect consumers from third-party debt collector abuse and harassment and strives to increase transparency in debt collection activities.

Here’s an overview of the FDCPA, who it applies to and who it protects:

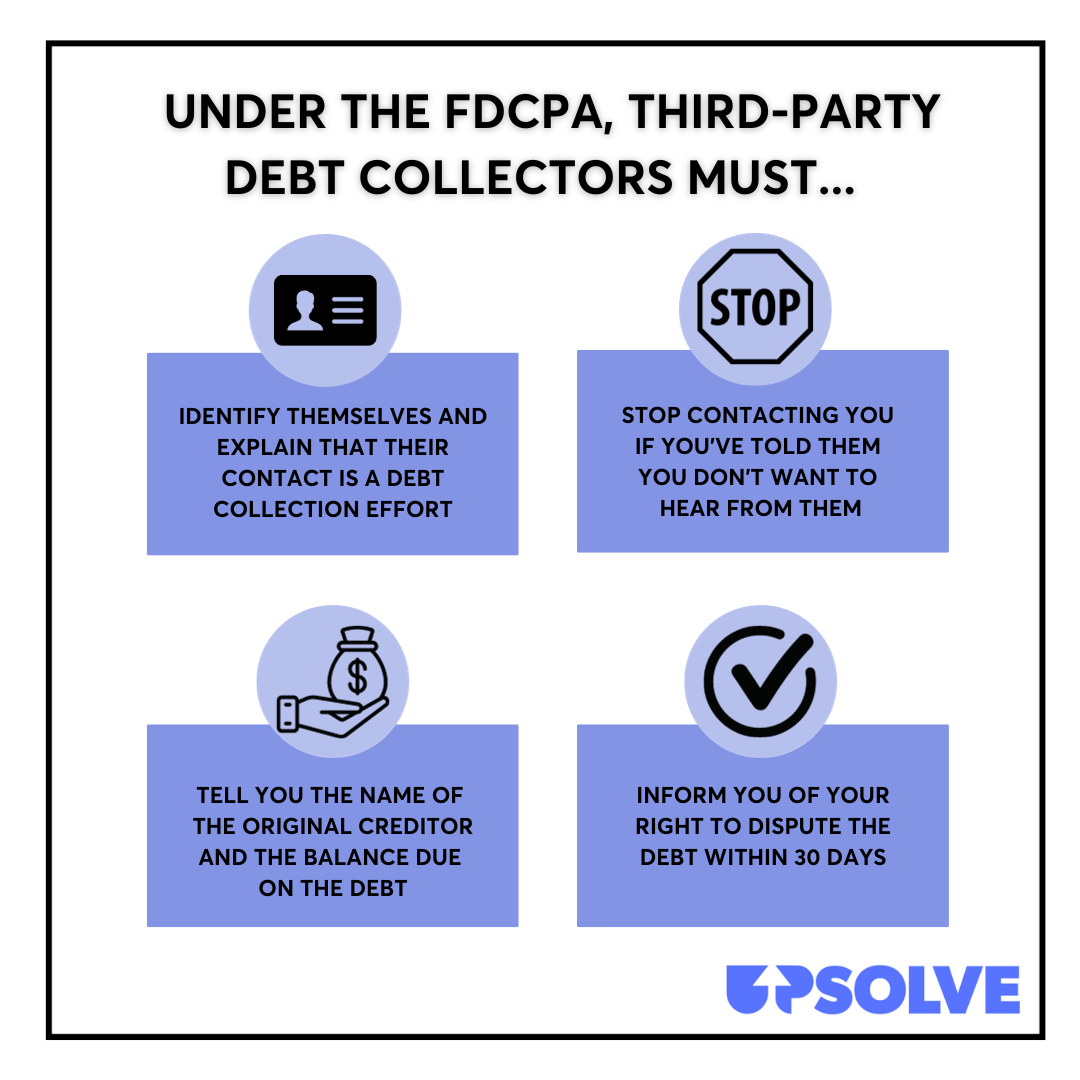

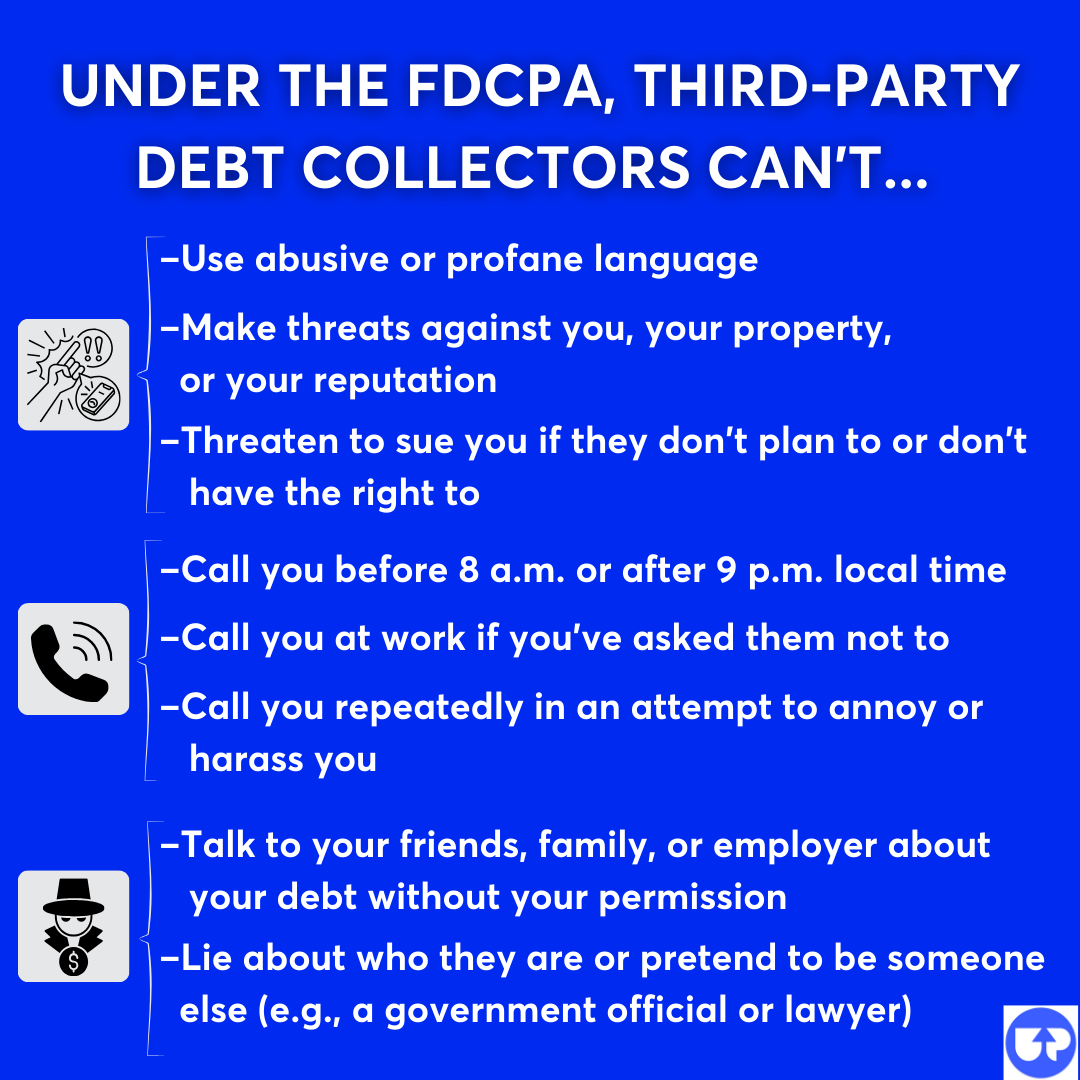

There are many things that debt collectors cannot do under the FDCPA, but there are also many things they are required to do.

As mentioned above, California’s Debt Collection Licensing Act requires anyone participating in regular debt collection activities in the state to be licensed.

Under state law, the debt collector should tell you their licensing number when they contact you. If they don’t, you have the right to ask for their licensing information. If this is in a phone call, write down who called, when, why, and what they said when you requested their license number. Getting this information can help you avoid debt collection scams and report unlawful activity.

If you’re contacted by email (or another digital formal like social media) or in a written communication, like a letter, the debt collector is legally required to include their license number in that communication. This can’t be in the fine print either. The law specifies that it must be in at least a 12-point font.

If you send a debt verification letter to get more information about the debt or to dispute a debt you don’t believe you owe, ask for this number in that letter as well.

If the debt collector doesn’t properly identify themselves, including their licensing number, you may be able to use this as a defense if they bring a debt collection lawsuit. You can also file a complaint with the agencies listed in the next section.

Absolutely recommend. Outstanding software that will ease the process of filing yourself. Easy to follow and understand.

Read more Google reviews ⇾ ★★★★★ 4 days ago The best decision I have made. Definitely the way to go. Read more Google reviews ⇾ Ititi Obidah ★★★★★ 4 days ago I am so grateful I found Upsolve to help file my case. You are a godsend. Thank you!! Read more Google reviews ⇾ Get Free HelpIf a debt collector makes harassing or repeated telephone calls, uses profane language, doesn’t properly identify themselves, or violates the law in any other way, you have two options: file a complaint with state or federal government agencies and/or bring legal action against the debt collector.

If a debt collector violates a consumer protection law such as the FDCPA or the Rosenthal Act, report them. Both state and federal agencies can look into the violation.

Start by filing a complaint online with the California Attorney General’s Office. This is the state agency that is tasked with investigating consumer complaints about businesses. The online complaint form asks for your contact information, information about the debt collector, and information about the incident. You can also upload supporting documents if you have them.

If you have a dispute or fraud issue with debt from California medical bills, you can file a complaint online for managed care plans and PPO coverage.

Finally, you can file a complaint with the Consumer Financial Protection Bureau (CFPB). This federal government agency works in tandem with the Federal Trade Commission (FTC) to help protect consumers across the U.S. You can file a complaint on the CFPB’s website.

You may be wondering if it’s really worth spending the time to do this. Keep in mind that the FDCPA and other state and federal protections are often made in response to concerning trends in consumer complaints.

You also have the right to file a lawsuit against a debt collector for violating state and federal collections laws. Under California law, you can bring a lawsuit against third-party collectors and/or the original creditor. Under federal law, you can only sue third-party collectors for FDCPA violations.

For both federal and state law violations, you may be able to recover actual damages (which often includes emotional distress and things related to it, such as lost wages) as well as additional statutory damages of up to $1,000. You may also be able to recover the attorney fees and court costs. Because of this, it’s often advisable to seek legal help if you want to bring a lawsuit against a debt collector. Some lawyers specialize in this and will work on contingency, which means you don’t have to pay them upfront.

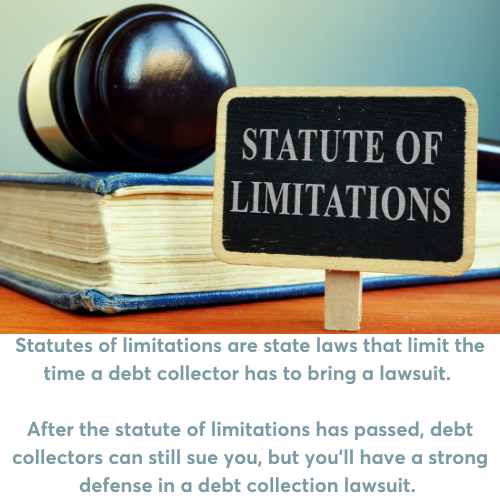

California also has statutes of limitations that limit the amount of time that you can be sued for a debt. These are outlined in California Civil Code.

For most consumer debts in California, the statute of limitations is four years. This means debt collectors have only four years to sue you for credit card debt, medical debt, and auto loans. For mortgage debt and personal loans, the statute of limitations is six years.

California statutes don’t allow debt collectors or creditors to sue for time-barred debts, but debt collectors can still send you written notices, call you, and report the debt to credit reporting agencies. You have the right to send debt collectors a cease and desist letter to demand they stop contacting you about an old debt. To learn more, read How To Write a Cease & Desist Letter To Stop Debt Collectors.

In some cases, your actions can restart the clock on the statute of limitations. Often, the clock starts when you default on the debt, but this can vary by type of debt and what’s in your debt contract. It’s important to be aware that if you acknowledge the debt, make even a partial payment on the debt, or agree to a payment plan on old debt, the clock may restart. If you think the debt is old enough to be time-barred (past the statute of limitations), it’s best to get legal advice from an attorney before you give information or agree to anything with a creditor or debt collector.

While there are state and federal consumer protection laws on the books to prevent debt collectors from acting badly, they are still legally allowed to contact you and even sue you to try to collect on an unpaid debt.

Before they sue, debt collectors and creditors will make repeated efforts to contact you and resolve the debt. This may go on for several months before they take legal action. If you get sued, you’ll receive a summons and complaint form with information about claim(s) against you. It’s important to respond to the summons. You can do this even if you can’t afford to hire a lawyer. If you don’t respond to the lawsuit, the most likely outcome is that the debt collector will win a court judgment against you.

With a court order, the debt collector can gain access to collection measures such as:

If the debt in question is an auto loan, you may also be at risk of repossession.

Here’s a guide to answering a court summons that’s tailored for residents in the state of California.

Consumer debt like credit card debt and medical bills are on the rise. If you’re feeling bogged down by spiraling debt, you're not alone. But if you take action now, you can prevent bigger problems in the future.

Start by getting a free session with a nonprofit credit counselor. Consumer credit counseling exists to help everyday people learn how to manage their finances, budget, and get on the path to being debt free. They’ll discuss your financial goals and challenges and recommend a debt-relief solution tailored to you. This could be anything from a debt management plan or debt consolidation to bankruptcy.

If you need legal help with a debt problem, you may be able to get free legal help from a legal aid agency.